13 March 2023

Faster approval process with Open Banking

Faster approval for your personal loan application with open banking

We’ve launched a new way to share your financial information with us via ‘open banking’. Our open banking partner, Plaid, allows you to securely share your information without printing, photocopying, downloading, or emailing bank statements. As a result of choosing this option, your loan application with Synergy Credit Union will be processed faster.

See the explainer video HERE.

What is open banking?

Open banking is a secure and safe way of sharing financial information such as bank account balances and transaction history. It was launched by the European Union (PSD2) to give consumers more control over sharing their financial information and data. Open banking and Plaid follow strict rules and stringent standards to keep your data secure.

How does it work?

When you apply for a loan with us, you will be given the option to share your account data with Synergy Credit Union using Plaid. This means you are giving Synergy Credit Union access to your latest bank statements. You do not have to contact your bank and request a statement and then wait for it to be delivered. This is a much more secure way of sharing your financial details with your Synergy Credit Union when applying for a loan.

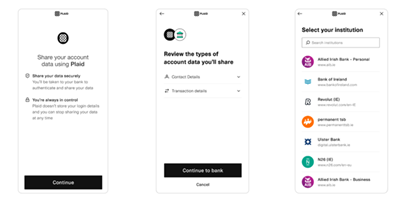

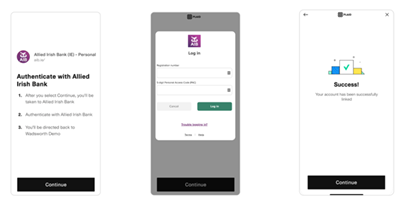

The process of sharing your information through Plaid takes just a few simple steps as shown below. Plaid will never ask for additional security information. It will only ask you to sign into your online banking.

1. What’s changing about how I apply for a loan?

Synergy Credit Unions is introducing a new option to make sharing financial information, such as your balance and transaction history, easier and faster via open banking. Our open banking partner, Plaid, allows you to securely share your financial information for loan eligibility without printing, photocopying, downloading, or emailing bank statements. We are doing this to save members time and hassle. When you connect your bank to Plaid, it will securely send a point in time snapshot of your financial information to your credit union. You do not have to use open banking, but if you do, your loan application will be quicker.

2. How does it make applying for a loan easier for me?

Your bank statements are securely shared with Synergy Credit Union. No printing or sending statements required. You can share statement with us in a couple of clicks. This results in a quicker turnaround time as we are granted instant access to your statements.

3. What do I need to know about open banking?

Open banking is a secure way of sharing financial information with other financial providers. It came into place in the European Union in 2018 to give consumers more control over their financial information. If you give your credit union open banking access, you can control what information you give and for how long.

4. What is Plaid?

Plaid is Synergy Credit Union’s official open banking partner. Plaid makes it easy to connect your current account and to share financial information with your credit union. Plaid is a technology company that powers financial service providers across Europe and North America. Plaid does this via open banking in accordance with EU regulations. Plaid is completely safe and uses best-in-class encryption protocols, secure cloud infrastructure, multi-factor authentication, and around-the-clock monitoring to protect users' data. You do not need to sign up for Plaid or take any action directly with Plaid.

5. Is open banking safe?

Open banking is very safe. Following the Payment Services Directive (PSD2), open banking was introduced in the EU in 2018 to make sharing financial information safer. Open banking technology follows strict rules and stringent standards to keep your data secure. For more information on Plaid safety, please visit https://plaid.com/safety/

6. What personal information is shared with Plaid?

None of your data will be shared without your consent, and the only data shared is within the permissions that you set. When you consent and connect to Plaid, it shares your financial information with your credit union automatically. You will only be sharing a point-in-time snapshot of your finances for the loan application process. You control what data is sent and for how long. At any time, you can revoke your consent.

7. What financial information can I share?

You can choose to share information from any payment account that can be accessed through online banking with your credit union. A payment account is an account that can be used to make payments to third parties e.g. current, credit card, some deposit and e-money accounts.

8. Can I revoke my consent?

Yes, consent can be revoked at any time. Your data is accessible to your credit union for a period of 90 days but only as part of the loan application process. Access can be revoked during that period if you wish by contacting Plaid or your bank.

9. Who will Plaid share your bank account information with?

Plaid will share your bank account information with Synergy Credit Union only after authorisation by you.

10. Is it mandatory for a Member to use Plaid when applying for a loan?

This is a new optional service. The choice is yours, but it will enhance your experience and the time taken to process your application.

11. How much does this service cost the Member?

There is no direct cost to you as a member if you avail of open banking