22 August 2024

Catch Up on College Savings for Your Child

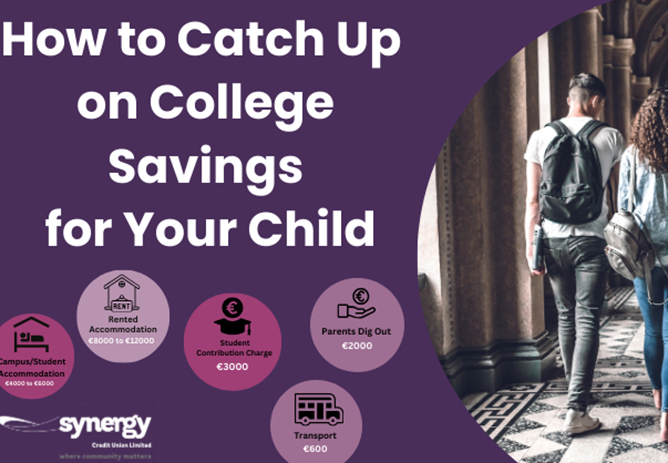

As the Leaving Certificate results are released and students eagerly await college placements, many parents of secondary school children are questioning whether they have sufficient resources to support their child's third-level education. College costs are significant, and by the time your child reaches university, the financial strain can be substantial. It's no surprise that accommodation and tuition fees rank among the highest expenses during the academic year. Accommodation alone can range from €4,000 to €10,000 annually, depending on whether you're paying for rented or student housing. On top of this, parents often provide their children with up to €2,000 to help with daily expenses throughout the college year.

However, it's not too late to catch up on your college savings. Whether you're starting late or haven't saved as much as you'd hoped, there are strategies to help you boost your college fund effectively.

1. Assess Your Financial Resources & Plan Accordingly

Before diving into saving strategies, it's crucial to understand your current financial situation. Take a close look at your monthly income, expenses, and existing savings. This will give you a clear picture of where you can potentially cut back or reallocate funds towards your child's college education. Writing everything down can help you stay organized and committed to your savings goals.

2. Short-Term Savings Options

With college just a few years away, short-term savings strategies are essential to achieve immediate returns:

Credit Union Account: Set up a dedicated account with Synergy Credit Union to keep your college savings separate and easily track your progress. These accounts often offer dividends, and when the time comes to pay those college bills, the funds will be readily accessible.

Financial Planning Consultation: Synergy Credit Union, in partnership with Irish Life Financial Services, offers a full financial review with Qualified Financial Advisers. This review can cover your protection, retirement, savings, and investment needs. It’s a free, no-obligation service that takes just 45-60 minutes and can be conducted online or over the phone at your convenience. Get expert advice tailored to your situation and make informed decisions about your savings strategy.

Make your free appointment here.

3. Explore Cost-Effective Accommodation Options

Accommodation is one of the most significant expenses associated with college, particularly if your child will be studying away from home. Consider the following alternatives:

Living at Home: If possible, have your child live at home during their college years. This can drastically reduce costs related to rent, utilities, and meals.

Shared or Purpose-Built Student Housing: If living at home isn’t feasible, explore shared accommodation with other students or purpose-built student housing, which may offer more affordable rates.

4. Utilise SUSI Grants and Scholarships

Don't overlook financial aid opportunities. In Ireland, several grants and scholarships are available to support students pursuing third-level education. For instance, the SUSI grant can significantly reduce the financial burden if your family meets the eligibility criteria. Encourage your child to research and apply for all available financial aid options early to increase their chances of receiving support.

See what grants are available from SUSI here.

5. Automate Your Savings

One of the most effective ways to build your college fund is to automate your savings. Set up a standing order to transfer a fixed amount from your current account to your college savings account each month. This "set it and forget it" approach ensures consistent contributions without the need to think about it regularly.

6. Consider Long-Term Financial Planning

Even if college is fast approaching, long-term planning is still vital. Synergy Credit Union’s financial planning services can help you maximise your savings and investments, not just for college but for your family’s overall financial well-being.

Explore our financial planning services here.

In Short :

Managing the financial demands of college can be challenging, but with thoughtful planning and strategic savings, you can help provide your child with the resources they need to succeed in college life.

Synergy Credit Union is here to assist you every step of the way, offering a variety of savings options and financial products designed to help you meet your goals.

For personalised advice, visit your local Synergy Credit Union branch or explore our financial planning services online at https://synergycu.ie/services/financial-planning

Disclaimer: The content provided in this blog is for informational purposes only and does not constitute financial advice, including but not limited to investment, tax, or retirement planning advice. While we strive to offer accurate and up-to-date information, Synergy Credit Union and the author are not financial advisors, and the insights shared here should not be construed as professional advice. The information provided is general in nature and may not be suitable for your specific financial circumstances. We strongly recommend consulting with a qualified financial advisor before making any financial decisions.Synergy Credit Union assumes no responsibility for actions taken based on the information provided in this blog.