11 June 2025

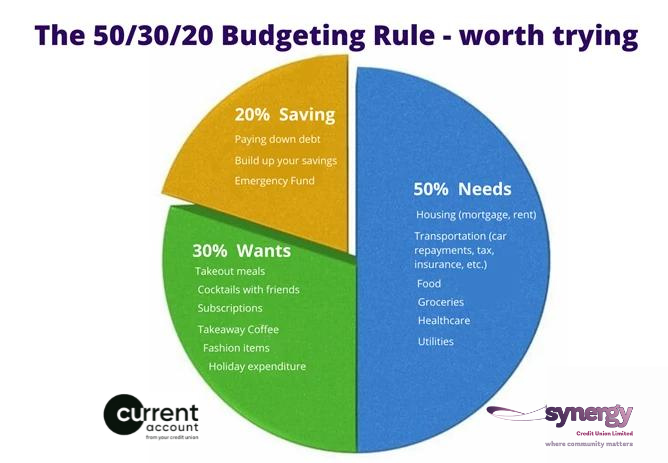

The 50/30/20 rule for budgeting. Well worth reading and trying.

There comes a time when you have to start saving. This could be for a mortgage, emergency funds, a wedding or another big ticket item that you will need funds for in the future.

Elizabeth Warren, a bankruptcy expert from Harvard, coined the phrase and it became very well-known from her 2005 book “All Your Worth: The Ultimate Lifetime Money Plan “. This rule has helped many people evaluate how they manage their finances

This rule splits your income after tax into portions: 50% of your income should go to needs, 30% goes to your wants and 20% should go to a savings plan.

This rule is very simple and realistic and is generous on how much you can spend on wants (30%) , maybe this a lot for some , but it may then make it more sustainable to stick to the rule.

If you're ready to give yourself a financial audit and try to tackle your financial situation, this simplified version of the 50/30/20 could be a good starting point, if only because it will force you to look at the way you spend.

Take an hour and figure out where you spend your money. Do it roughly first and work out approximately where your income goes. You can always start to write down or record your spend going forward

Once you have figured out how you spend money, you can create a budget. Base it on the 50/30/20 to get you started.

Basically you have to spend less money than you bring in.

Do you want a Free Financial Review to help you?

Talk to a financial advisor where you get a personalised report detailing your current financial status and options to consider, including the steps needed to help protect you and your family, and how to plan ahead for the future.

Take the time to review your protection, retirement, savings and investment needs online or over the phone at a time that suits you by making an appointment here: https://synergycu.ie/services/financial-planning

Here are some points to ponder:

Spend less - cut out all unnecessary spending. Do you need that Netflix or sky subscription, do you actually benefit from that gym subscription, can you cut out the cocktails or night out, do you really have to spend so much on Christmas. Is there anywhere you can cut out unnecessary spending?

Boost your income- can you reclaim tax back from revenue , is there a possibility of working some overtime , can you increase your salary by retraining or doing an evening course, is there a way to earn extra money whilst still having a good life /work balance. If you cannot cut back the spending you have to increase your household income.

Ditch the Credit or Store card: - if you are using a store or credit card, you are more than likely living beyond your means or have the potential to spend beyond your means. It is very easy to end up spending more than you are paying on your credit card and before you know it you have a high card balance that is being charged at a very high interest rate. If you have an outstanding credit card or bank loan - take a look at our switch and save loan product to see how much you might save by switching to your local credit union.

Don’t try to keep up the Jones's: Resist the pressure to do what your neighbours are doing, every household’s income level is different. You can use credit or cards to make you look wealthier than you are but in the end you end up in financial trouble. Stick to your budget and ignore the Jones's

Get an emergency fund together: Having an emergency savings fund will keep you from resorting to easy and high cost credit such as credit cards. Building up towards 3 to 6 months household income would be a fantastic achievement but starting out with a few hundred euros in a special account will get you started. Use your budget to put some income towards this each month