Open Banking

Open Banking

Faster approval for your personal loan application with open banking. Securely share your information without printing, photocopying, downloading, or emailing bank statements.

We’ve launched a new way to share your financial information with us via ‘open banking’. Our open banking partner, CRIF, allows you to securely share your information without printing, photocopying, downloading, or emailing bank statements. As a result of choosing this option, your loan application with Synergy Credit Union will be processed faster.

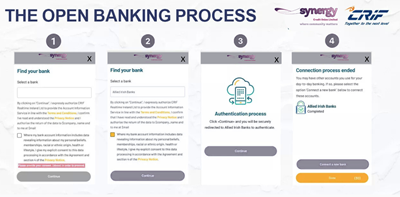

Complete the process in the following easy steps:

1 For Synergy Service Credit Union to use the services of CRIF, they need your consent which you will be prompted for at the appropriate time in the Public Service Credit Union APP. You should also review CRIF’s privacy policy and terms of service. | 2 You will be asked to select your bank account provider from a list. CRIF currently works with most of Ireland’s main banks. | 3 Under the second Payments Services Directive (PSD2), all banks in Ireland have to allow Open Banking connections, so if your bank is not currently featured yet, it soon will be. |

4 You will automatically be redirected to complete Strong Customer Authentication with your Bank. Each bank shows this step slightly differently, but all will present you with a list of the accounts you hold with them. | 5 Please select all of the bank accounts you hold with your bank (apart from business bank accounts) and approve in your banking app. | 6 You may wish to connect accounts from several providers. If this is the case, choose the option to ‘Connect another account’. If you are finished, choose ‘Return to hub’ to continue uploading any remaining documents requested by us. |

What is open banking?

Open banking is a secure and safe way of sharing financial information such as bank account balances and transaction history.

It was launched by the European Union (PSD2) to give consumers more control over sharing their financial information and data. Open banking and CRIF follow strict rules and stringent standards to keep your data secure.

How does it work?

When you apply for a loan with us, you will be given the option to share your account data with Synergy Credit Union using CRIF. This means you are giving Synergy Credit Union access to your latest bank statements. You do not have to contact your bank and request a statement and then wait for it to be delivered. This is a much more secure way of sharing your financial details with your Synergy Credit Union when applying for a loan.

The process of sharing your information through CRIF takes just a few simple steps as shown above. CRIF will never ask for additional security information. It will only ask you to sign into your online banking.

Open Banking gives you the option to securely share your online payment account information with authorised providers you trust. These are known as third party providers (TPP's).

Open banking is a secure way of sharing financial information with other financial providers. It came into place in the European Union in 2018 to give consumers more control over their financial information. If you give your credit union open banking access, you can control what information you give and for how long.

Yes. A TPP will be regulated in the same way that a Bank is, and so must follow the same laws to keep your information safe and secure. We take your privacy very seriously. We do not share any of your bank account data for marketing purposes.

At no point do we ever see or have access to your banking passwords. Synergy Credit Union cannot in any way affect your bank account. CRIF can only gain read-only access to your data once you approve the request in your banking app.

No. You are in control. If you do not wish to share your data with Synergy Credit Union's CRIF Open Banking service, you can choose our manual upload option and supply PDFs of your bank statements instead.

Please be advised that providing your bank statement information to us in PDF format may lead to a delay in getting your application processed.

Open Banking enhances your loan application experience with us, making it more seamless.

There is no direct cost to you as a member when you use Open Banking.